Yes, Hindu law permits women to inherit property and gives them equal rights in inheriting property. Before 2005, Hindu women did not have the right to inherit property. In 2005, the Parliament passed the Hindu Succession Amendment Act, which gave women equal rights to inherit property.

Hindu women can inherit all types of property:

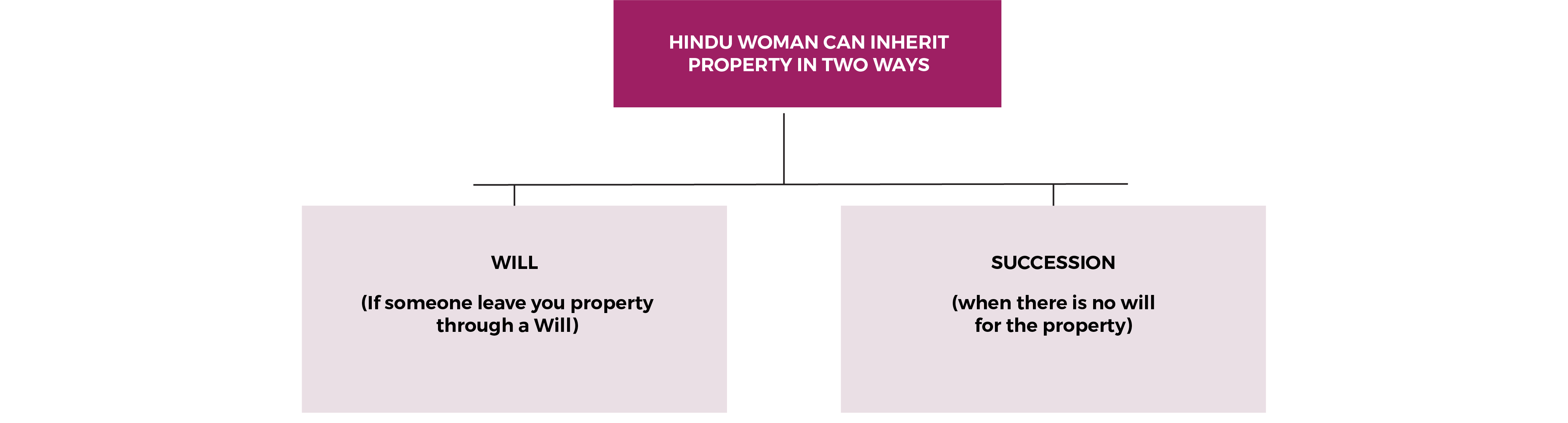

There are two ways in which a Hindu woman can inherit property:

If someone has left property to you in their will, after that person’s death, you will automatically inherit that property. Usually, there will be an administrator/executor for the will. The administrator/executor will take care of passing on the property according to what is given in the will.

What you need to do:

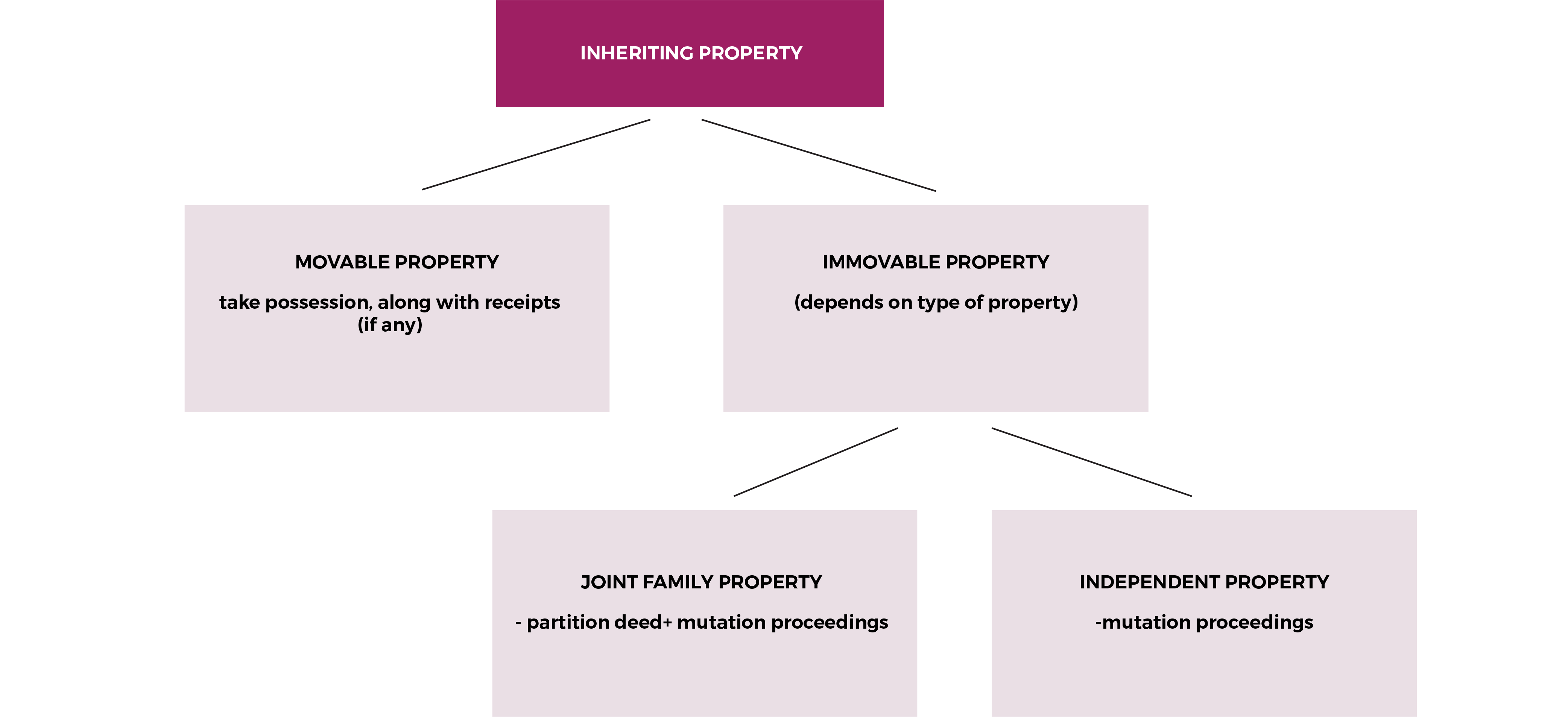

For movable property:

If it is movable property, you need to simply take physical possession of the movable property.

In the case of jewellery – make sure to also take the receipts and certificates of authenticity of the jewellery.

For immovable property:

If it is immovable property, what you need to do will depend on whether the property is joint family property or independent property.

Paperwork for immovable property:

Practical tip: The paperwork required may change from state to state because each state government has its own system.

When there is no will, the property will pass on through succession according to the inheritance rules of the Hindu Succession Act. Succession rules are different for the property of males and property of females.

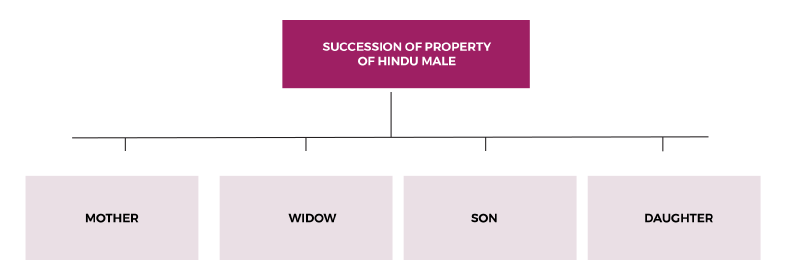

Succession to The Property of a Deceased Hindu Male:

If a Hindu male dies without leaving a will, his property will get equally divided between his Class I heirs.

Class I heirs of a Hindu male are:

There are some other Class I heirs, who will come into the picture if any of the sons/daughters of the Hindu male have died, leaving behind their own families, like the wife of the deceased son (i.e. widowed daughter-in-law), children of the deceased son/daughter (i.e. grandchildren), etc. Such situations are not very common.

Few points to note:

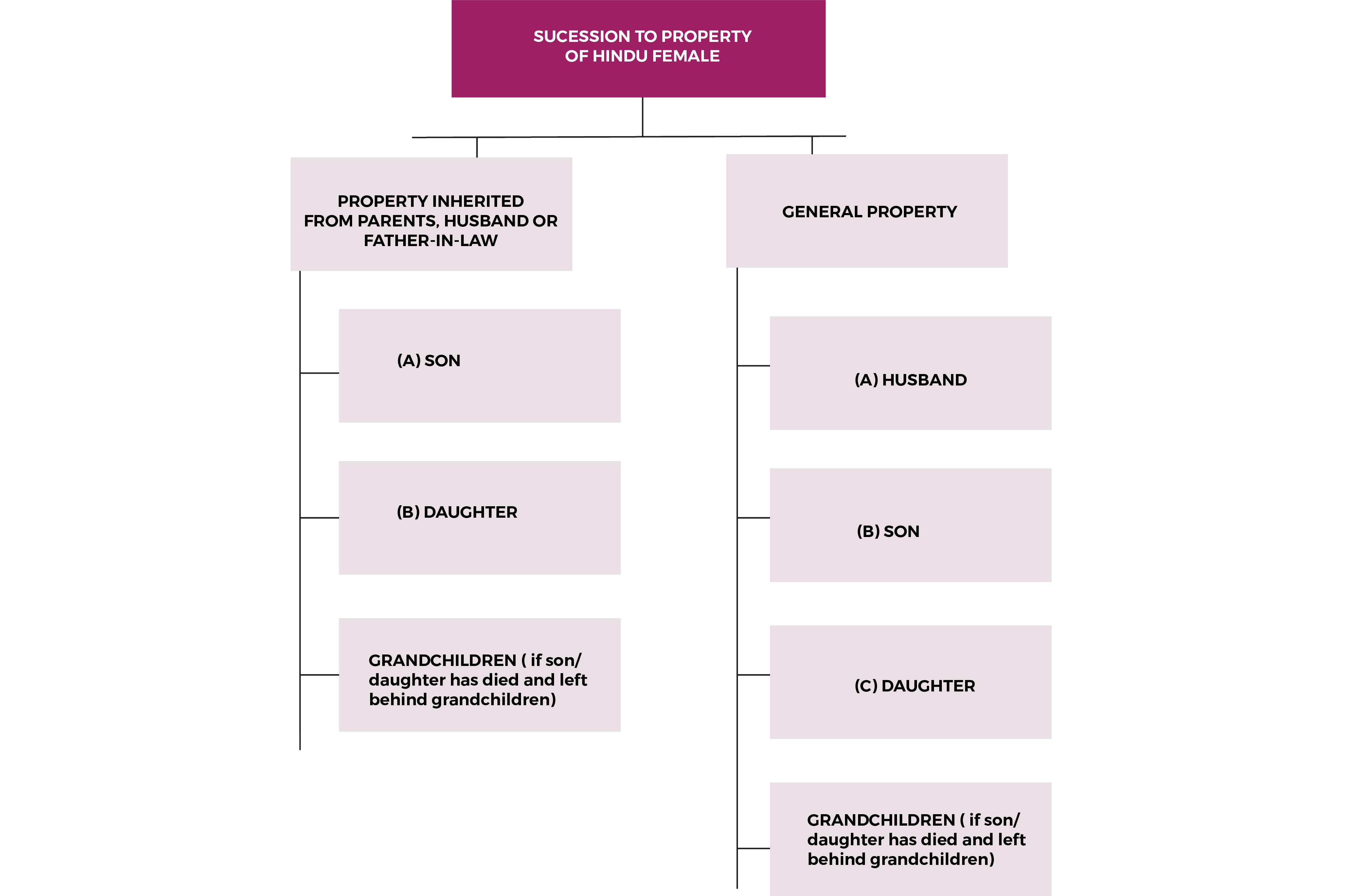

Succession to The Property of a Deceased Hindu Female:

If a Hindu female dies without a will, her property will pass on through succession as per the Hindu Succession Act. Just like a Hindu male’s heirs (Class I, Class II, etc.), a Hindu female’s heirs are also divided into different categories.

A Hindu female’s heirs are classified based on how she gets the property:

Property inherited from her parents, husband, or father-in-law, i.e. property which she gets from these people through succession under the Hindu Succession Act. This does not include property which she gets from these people through any other form like will or gift.

Class I Heirs for this category of property are:

Note: Husband does not fall under this category. Husband will not get a share in his wife’s property which she has inherited from her parents/father-in-law through succession.

Points to Note:

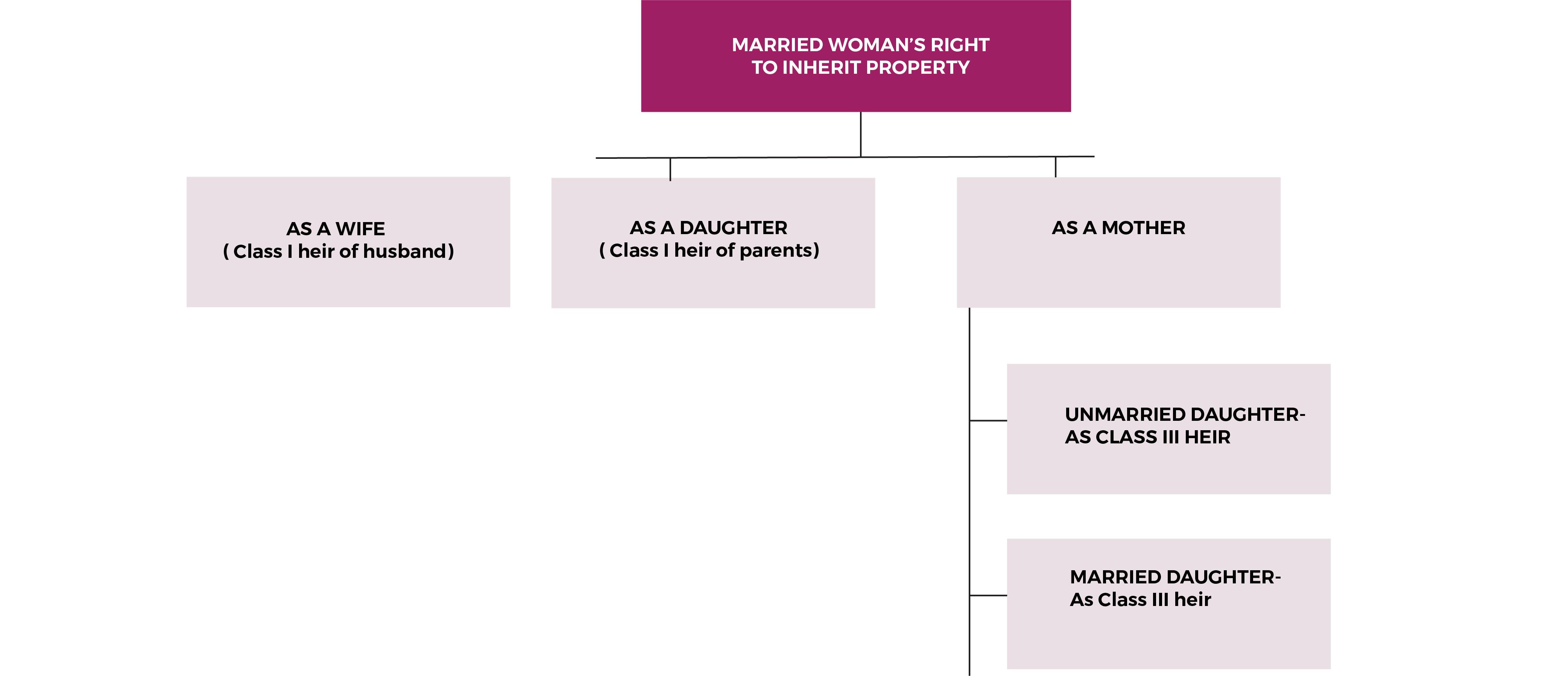

Know your Inheritance Rights Based on Marital Status

In this section, we have explained to you about which family members you can inherit property from, when there is no will. You should read this section along with the above section where we have explained the heirs of a Hindu male and Hindu female, to get a complete understanding.

Remember: Apart from inheriting property through succession, you can also get property in the following ways:

An unmarried woman can inherit her parents’ property as a Class I Heir for both mother and father.

Marriage will not affect your right to inherit parents’ property. You will still remain a Class I heir.

A married woman can inherit property in the following manner:

The rights of a widow to acquire property are the same as the rights of a married woman to acquire property (explained above).

If you are separated from your husband (but not divorced), your rights to acquire property are the same as the rights of a married woman to acquire property (explained above).

If you are divorced from your husband, you will not be a Class I heir of your husband. However, you can still claim your due share in your husband’s property through alimony.

Your rights to inherit property as a daughter and mother will remain the same.

Please note: This information has been made available to you for your benefit on an ‘as is’ basis, and is only for your information. It does not constitute legal advice and cannot substitute professional legal advice. Our disclaimer policy can be viewed here ( disclaimer policy)